99Defi.network is a permission-less decentralized protocol that enables lending and borrowing services through Blockchain smart contracts.

Decentralized p2p network for secured loans. Crypto loans. Cryptocurrency loans – Borrow digital assets now!

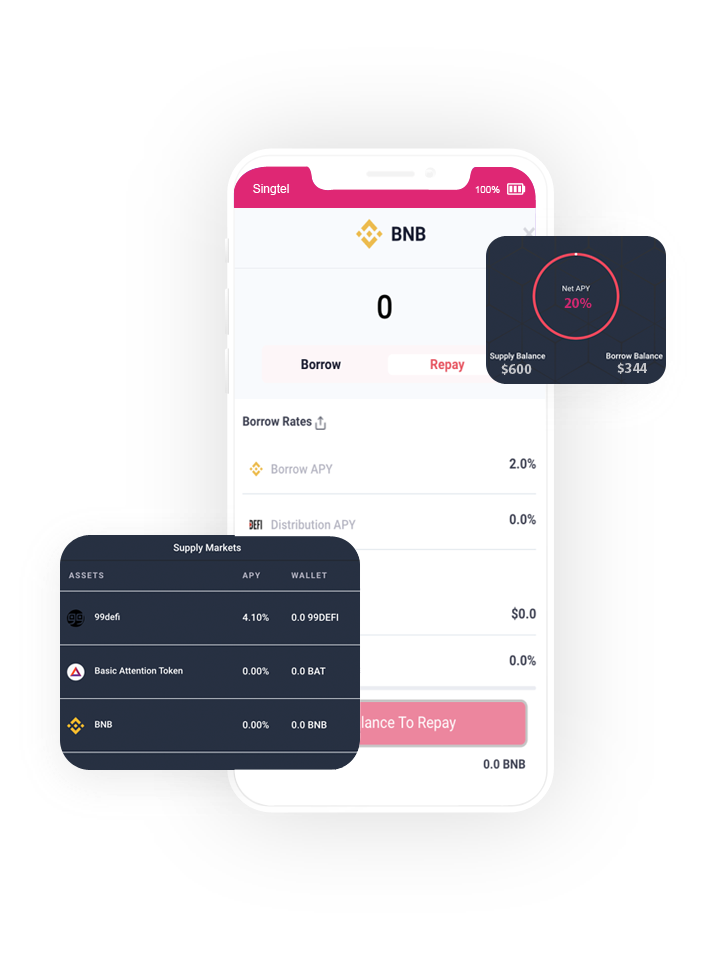

Platform Built With 99DEFI

99defi.network

99defi.network -cryptocurrency p2p platform for crypto loan services. Be a part of 99defi network and participate in our initial exchange offering. 99defi ICO, 99defi IDO, 99defi.network – BSC binance smart chain sales.

99defi.network – P2P platform. Participate in IDO/ICO of 99defi. Cryptoexchange. Blockchain. Crypto. Decentralized. Peer-to-Peer.

99Defi Non-Custodial Protocol

Peer-To-Peer Lending And Borrowing Protocol

99Defi Protocol enables you to Borrow and lend in a safe and transparent way. The 99DEFI smart contract automatically matches borrowers and lenders and calculates interest rate based on the ratio of borrowed to supplied assets.

Platform Functions

Blocks Of 99DEFI

99defi. Blocks of 99defi p2p platform functions.

Earn Interest

By Lending

Find someone to “rent” your crypto assets on your terms. Your collateral is held safely by a smart contract as an escrow agent.

Borrow Assets To Trade

In Crypto Market

Get liquid assets you need without selling long‑term holdings to go short, invest into ICOs or use assets in other trades.

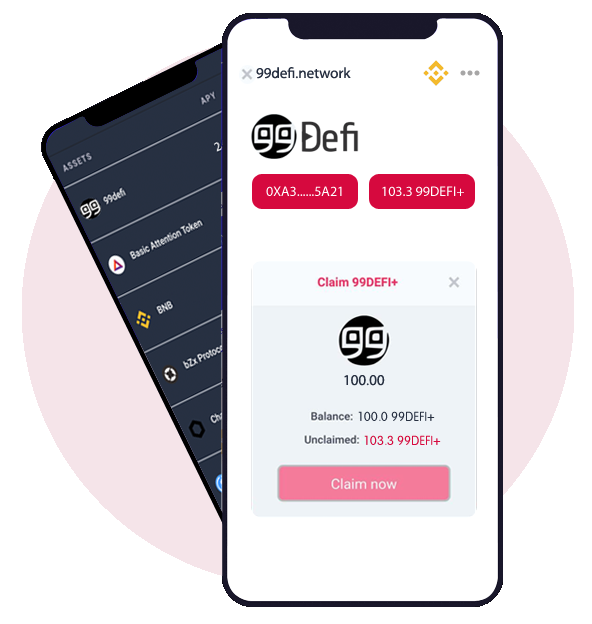

Claim Your

Reward

Earn additional 99Defi + governance token for all your supply. Contact us for more details on how to participate.

99defi. Trade your favorite cryptocurrency with our p2p trading and borowing platform. Bitcoin (BTC), Ethereum (ETH), Binance coin (BNB), XRP, Cardano (ADA), Bitcoin Cash (BCH) Doge coin, VET, Solana (SOL), UniSwap (UNI), Litecoin (LTC). USD Coin USDC, Polkadot DOT, Terra LUNA, Chainlink LINK, Internet Computer ICP, Wrapped Bitcoin WBTC, Polygon MATIC, Ethereum Classic ETC, Stellar XLM, VeChain VET, Avalanche AVAX, Tron TRX, THETA, USDT, 1inch, CACKE Pancakeswap, XMR Monero.

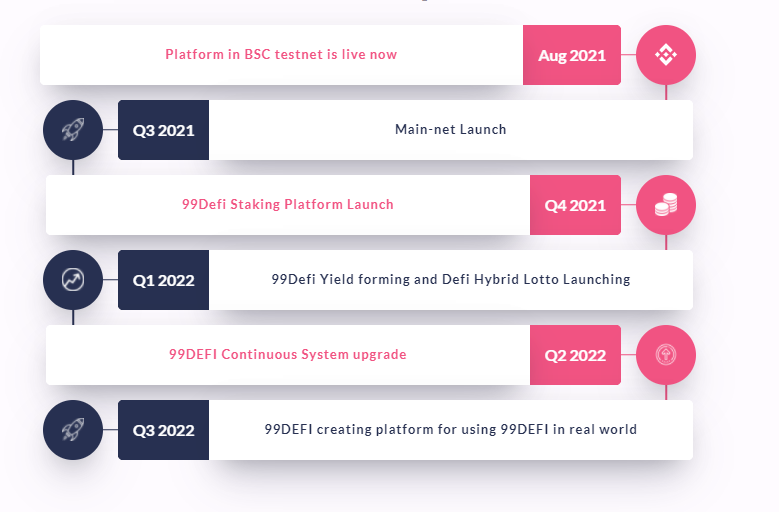

99defi - RoadMap

99defi – RoadMap – Timeline.

Peer-to-Peer – P2P

P2P lending websites connect borrowers directly to investors. Each website sets the rates and the terms and enables the transaction. Most sites have a wide range of interest rates based on the creditworthiness of the applicant.

First, an investor opens an account with the site and deposits a sum of money to be dispersed in loans. The loan applicant posts a financial profile that is assigned a risk category that determines the interest rate the applicant will pay. The loan applicant can review offers and accept one. (Some applicants break up their requests into chunks and accept multiple offers.) The money transfer and the monthly payments are handled through the platform. The process can be entirely automated, or lenders and borrowers can choose to haggle.

Peer-to-peer lending connects potential borrowers directly with individual investors who finance loans.

It’s a relatively new approach to the borrowing-and-lending experience. By cutting out traditional financial institutions like banks, borrowers may be able to access funds quickly, and investors might get a healthy return.

Borrowers apply for loans on peer-to-peer lending platforms, while investors select loans that seem like a good risk. An investor can choose to fund a portion of a loan (or multiple loans) individually. Borrowers may receive funds from multiple individual investors.

RoadMap

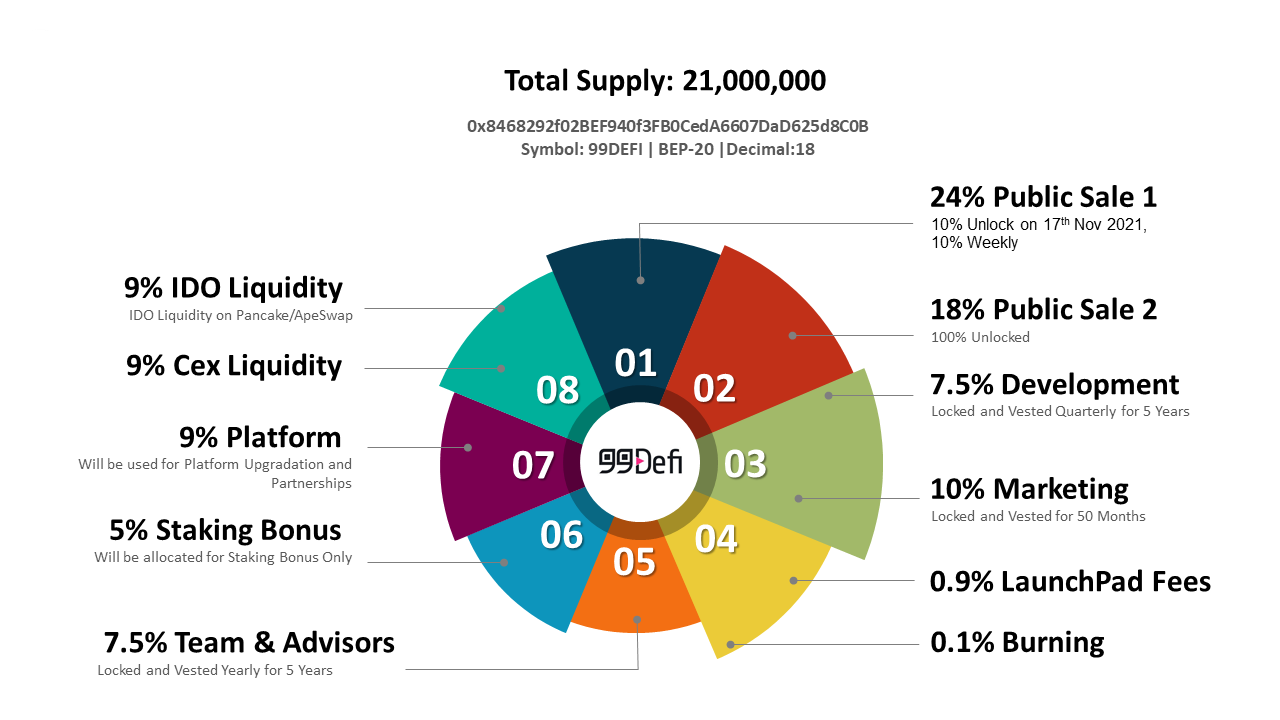

Tokenomics 99defi p2p network

Tokenomics – 99defi p2p network – Coin details, distribution and contribution of 99defi crypto project!

Project Support Companies 99defi partnerships

Crypto and Blockchain Developers. Meet our team!